How To Build Wealth In Your 50s

Posted on:

Raffi Pailagian

MBA, BSc, DipFP

Financial Planner / Managing Partner

7 Things To Think About

In your 50s, many people start to worry, even panic, that they have left it too late to start building the wealth they will need for their retirement. But in fact, there are lots of opportunities to increase your savings and build wealth if you look for them. This article looks at how to build wealth in your 50s and breaks it down into the top 7 things you may want to investigate.

Keep in mind you are typically at your highest earning capacity between the age of 45 to 55 years old. [i] At the same time, your expenses are likely to be reducing as your children grow up, start working and leave home. This is the perfect time to put that surplus cash to good use and supercharge your financial plan in preparation for retirement.

First Think About Your Destination

You can’t work out how to get somewhere unless you know where it is you are going. If you haven’t already, your 50s is a great time to start thinking about what you might want to do in retirement, and when that might be. This will, inevitably, lead you to a better understanding of how much money you will need. From there, it’s easy to work backwards to see how much you will need to build your savings until retirement.

Our article When Should You Start Planning for Retirement can give you some pointers here.

So, let’s look at these wealth building opportunities:

1 – Eliminate Debts

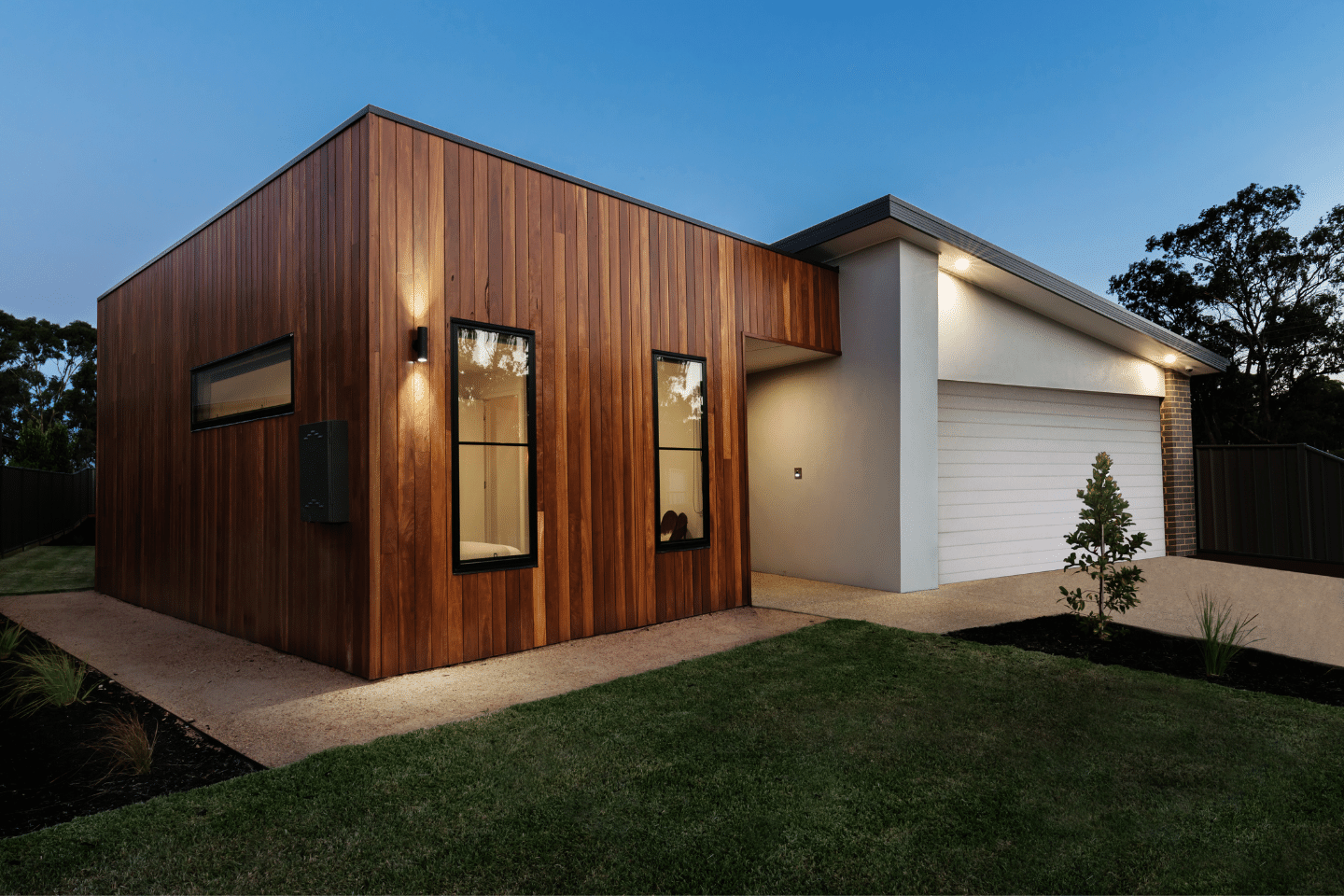

Now is the time to think about getting any debts you may have paid off. It’s likely that your retirement income will be less than your working one, so get those debts out of the way now and your retirement income will be all yours to spend how you wish. A few things to look at might be:

- Consolidate any personal loans or lines of credit into the lowest interest rate loan possible, usually your mortgage

- Pay off your mortgage as quickly as possible by setting up an offset account and increasing your payments over and above the minimum

- Now may be the time to start thinking about downsizing your home so you can use the equity left over to pay off your mortgage, and maybe even top up your super. Speaking of super…

2 – Superannuation

Super might not be very glamorous, but it is very effective. Super provides a great way to save for the future, access better rates of return than those offered by the banks, and at the same time minimise your tax exposure, both now and in retirement.

As you move closer to your preservation age, the rules around how much you can put into super start to shift, so keep up to date with what you are allowed to do and wherever you can, take advantage of it. Consider:

- Putting any lump sums like bonuses or additional commissions you earn into your super

- Maximising your use of salary sacrifice and voluntary contributions

- If you pay off your mortgage, putting those old mortgage payments straight into super rather than spending it, before you get used to having it

3 – Review Your Risk Profile

Whilst we all have a natural base-line risk profile, throughout life that profile does change. Generally speaking, as we move towards retirement our appetite for risk usually reduces.

During your 50s is the ideal time to think about your profile and reduce your risk exposure, as it gives you time to make small, considered changes to your investment strategy when the market allows, ensuring you don’t find yourself trapped in a situation where you might have to bear a loss.

4 – Growth & Income

This is also the time to start thinking about the mix of growth vs income investments you have. In the early stages of wealth building, we are generally looking for growth investments. And while this is still somewhat true as we approach retirement, the balance will begin to shift towards income. Again, the earlier you start thinking this process through, the best placed you will be to take your time and make changes when the market is most advantageous for you.

5 – Insurance

Insurance is essential to the security of your financial plan, but as you age it can also become expensive. Think carefully about the type and level of insurance you need to protect yourself and your loved ones, and look at ways to maximise the benefits while minimising the cost.

Again, any savings you make, drop them straight into your mortgage or your super. You won’t miss what you’ve never had!

6 – Helping Out Your Kids?

This one might touch a nerve. It’s a natural inclination to want to help your children out, especially when you see them trying to pay off a HECS debt, or save for a deposit. But you have to be realistic.

Once you retire, that’s it. What you have will need to last you, so it’s worth being a little wary. You need to consider very carefully whether or not you can afford to help your children out. Impartial, professional advice is a good idea.

If you do decide to help your kids out, think about whether you might want to be repaid at some point. If you do, have an open and honest conversation with them, setting out the terms under which you would like to be repaid. Then get it all in writing so there are no misunderstandings.

It might seem extreme, but getting legal advice will protect everyone involved and avoid potential bad feelings later on.

7 – Professional Advice

The old saying ‘a stitch in time saves nine’ also applies to financial advice. Australians are often loath to pay for financial advice, but if you could spend $1 to make $10 wouldn’t you do it? That’s the way to think about financial advice. At no time is this more important than when you are heading for retirement. The stakes are high and the rules are constantly changing. Experienced, professional advice can make all the difference.

If you would like personal advice on building wealth in your 50s, Manly Financial Services have the experience and knowledge to help you. Give us a call on (02) 9976 3388 or click below and we’ll be in touch shortly.

Interested in knowing more?