How To Build Your Investment Portfolio

Posted on:

Raffi Pailagian

MBA, BSc, DipFP

Financial Planner / Managing Partner

How To Build Your Investment Portfolio – Assets, Risk & Return

(00:00): In this video, I’ll be talking about asset allocation, where to invest and what level of growth, income, and risk you should expect. Hi, it’s Raffi from Manly Financial Services. And in this video, we’re going to talk about asset allocation. But before we start, two things we won’t be talking about.

(00:22): We won’t be talking about investing in just one asset class, be it property or whatever it may be. There’s a lot of videos on YouTube about buying one investment property and then buying a second one, a third one and a fourth one. We’re not going to be talking about that.

(00:35): Our approach as financial planners is putting together a diversified portfolio that’s going to help reduce risk and achieve your goals over the long term no matter what the investment cycle is giving.

(00:45): The second thing we won’t be talking about here are any get rich quick schemes as our focus is primarily establishing a core portfolio of diversified assets around which a satellite approach can be used and by satellite, I’m talking about different assets being alternative investments, alternative asset classes, maybe cryptocurrency, all sorts of things.

(01:06): But that’s really not the focus of this video. The focus of this video is looking at the traditional asset classes and how to asset allocate across those in a diversified way for your core portfolio.

Where Can We Invest

(01:18): So let’s start. Where can we invest? Well, traditionally there’s really only four asset classes that we can invest in. There’s cash, there’s fixed interest or bonds, there’s property or there’s shares. Now within each of those sections, there’s subsections.

(01:32): For instance in bonds, we can invest in corporate bonds or government bonds, we can invest in mortgages. In property, we can invest in commercial property, residential property, or listed commercial properties that are listed on the ASX, that we can buy and sell every day.

(01:47): In shares we can buy international shares or Australian shares and then within each of those sectors, we can look at different sectors of the market. We can look at different sizes of companies, small companies, mid cap companies, or the big blue chip companies.

Allocating Across The Four Core Traditional Asset Classes

(01:59): When allocating across these four core traditional asset classes, it’s very important for us to keep in mind that each one of these asset classes have some characteristics and those characteristics will determine if investing in these assets is appropriate for us.

(02:14): So the first of these characteristics are whether the asset is a growth asset or a defensive asset. Again, in the versified portfolio, we want to have an allocation to defensive assets that’s going to buffer the portfolio from extreme volatility, that may occur when you’ve got events such as a COVID-19 or a global financial crisis and the ramifications for that on the markets.

(02:34): Now, our defensive asset classes are a cash and fixed interest, whereas our growth asset classes are property shares. When we allocate money to bonds or cash, we expect that all we’re going to receive is interest in the form of income. Whereas when we invest in growth assets, we expect income and growth over that period of time.

(02:53): So from these defensive and growth assets, what type of return would we expect over a longer period of time.

Investment Return

(02:59): Investment return technically has two components. It has an income component and it has a growth component. Now, the defensive asset classes traditionally only really pay the income component.

(03:08): For instance, if I put money in a term deposit or in the bank, I’m only going to achieve investment income in the form of interest. I’m not going to get any capital growth. Whereas if I invest in property or shares, I’m going to get income in the form of dividends and rent, combined with capital appreciation or growth over a period of time.

Risk & Volatility

(03:32): What about risk and volatility? Well, that defensive asset’s, just as the name says, are going to be lower risk assets. Volatility, you want it really occur, especially for a cash asset you want to give volatility it all, possibly in a bond.

(03:44): Depending on the timeframe, you might get a little bit of volatility in terms of the capital value. But traditionally, defensive assets have very little or no volatility and therefore are very little risk.

(03:56): When it comes to our growth assets on the other hand, our property and our share assets, they are going to have some volatility over time, that volatility, or if you look at it from a day-to-day basis can be quite large, especially for shares that are traded on a daily basis on the stock exchange. However, over the medium to longer term, that volatility really gets ironed out.

(04:15): So when we look at these four traditional asset classes and we put them on a chart of risk versus return, We can see that cash and fixed interest will be on the lower return side and definitely at our risk side, whereas our property in shares will be at higher potential return and therefore higher ongoing risk.

Investing Across Asset Classes

(04:32): So how do we allocate across assets for an investor when we’re putting together their core portfolio? We take on two approaches. The first is a goals-based approach, and the second one is a risk profile approach. So firstly, from a goals-based perspective, we look at what they want to achieve over the short term, the medium term, and the long term.

(04:48): Our assets that are going to be less volatile should be in that short-term bucket and medium term bucket, can take assets that are going to have a little bit more volatility, because we’ve got more time to iron out that volatility and the higher risk assets in the longer term bucket.

Attitudes To Risk

(05:04): The second thing we’re going to be looking at is their attitudes to risk via a risk profiling tool to understand the client’s most appropriate level or comfortable level of investment risk and volatility.

(05:15): Now, as you can tell from a lot of this information, it is highly specific and specialized for the client. Therefore, this video only is talking in a general perspective and is only general advice. It’s not giving any specific advice that anyone should act on because obviously it doesn’t consider the circumstances of any of you viewers.

(05:33): To look at our full general advice disclaimer, please look at the description in this video.

(05:38): I hope you found this video of interest and if you’d like some more information, please visit our website at manlyfs.com.au and please get in contact so we can see if we can help you. Please like, subscribe, and leave a comment and click the notifications bell to we notify of any upcoming videos. Thank you.

Interested in knowing more?Related

Related Posts

Investing In A Low Interest Rate Environment

Almost unbelievably, the last time there was a rate rise in Australia was November 2010, when the rate went from 4.5% to 4.75%. It’s been…

Read More

Australian Inheritance Tax

Many Australians are still confused about Inheritance Tax & whether Australian Inheritance Tax EVEN EXISTS. So does it?

Read More

Maximising Superannuation Contributions Before EOFY

Maximising Superannuation Contributions before EOFY, can significantly enhance retirement outcomes, but would it for you?

Read More

Why Financial Literacy Matters

Financial literacy is more than a precaution, it’s a strategy that empowers you to make sound, informed decisions regardless of market fluctuations

Read More

Retirement Planning Strategies For Australians

Retirement Planning is one of the most important financial decisions you need to make & these key strategies will help you build a solid foundation for your golden years

Read More

How To Build Wealth

10 actionable strategies to help you build wealth and secure your financial future, in an easy to digest summary format

Read More

How to Fix Your Cash Flow

Wondering how to fix your cash flow? If yes this short video and article, which outlines some simple, easily implemented steps will be worth 4min’s of your time.

Read More

Negative Gearing – Is It A Good Strategy?

Whether it’s property or shares, negative gearing has sparked debates for decades, praised for its tax benefits but is it a good strategy?

Read More

Australian Gift Tax

Gifting can be a powerful way to share your wealth, but it’s essential to understand the tax implications

Read More

Is Your Retirement Plan on Track?

Retirement is a significant milestone in life, so how do you ensure your retirement plan is on track to provide the lifestyle you desire?

Read More

How To Create Generational Wealth

If you’re interested in understanding effective strategies to create generational wealth with property, then this article is for you!

Read More

Downsizing

Downsizing is a significant life decision that can have far-reaching impacts on both your financial health and overall well-being

Read More

Intergenerational Wealth Transfer

In this episode we discuss intergenerational wealth transfer & optimal strategies you may want to consider

Read More

Tax Effective Investing In Australia

Is your investment strategy optimised for tax efficiency & what should tax effective investing in Australia ideally include?

Read More

Investment Opportunities

With so many investment opportunities being created by the current global market environment, where should you focus?

Read More

Building Generational Wealth

Understanding the principles behind building generational wealth is becoming of increasing interest, driven by amongst other things the current cost of living increases

Read More

Mortgage Rate Update

We are celebrating our 11th Year Helping clients reduce their interest rates and realise their dream of buying a home or investment property

Read More

De-Risking Business Growth

Although de-risking business growth stands as a fundamental goal for every ambitious venture, these 6 strategies are often overlooked

Read More

Super Death Benefit Tax

In Australia, superannuation is a nest egg many rely on for a comfortable retirement, but what happens to your super savings if you pass away?

Read More

The Concessional Contributions Cap

Understanding the concessional contributions cap can be a powerful tool for building retirement savings & maximising your super

Read More

Downsizer Contributions

What Is the downsizer contribution concession and why could this be relevant to you if you’re nearing retirement?

Read More

Risk Profiling

Risk Profiling is possibly the most important but often the most misunderstood and overlooked element when investing

Read More

How To Use Debt To Create Wealth

Not all debt is created equal. In fact, if you’re careful and think about it strategically, you can actually use debt to create wealth

Read More

Looking for a Home Mortgage?

Developing a good understanding of the key concepts, before looking at specific mortgage products, can help with fast tracking the selection process.

Read More

What Is Refinancing?

What is refinancing, when should you do it, does refinancing impact your credit rating, & is there anything else you need to know?

Read More

Financial Wellbeing

It’s easy to assume higher income means more financial wellbeing, and there is a strong correlation, but it is not the only factor at play.

Read More

Why Use A Mortgage Broker

With a wealth of information at all our fingertips thanks to the internet, you might wonder why use a mortgage broker?

Read More

Reasons To Refinance

With interest rates rising, it’s worth understanding how you can benefit by going to the trouble of refinancing.

Read More

Tax Deductions On Investment Property

Property is a popular investment asset, particularly in Australia, due to whole host of attractive benefits which include the allowable tax deductions on investment property

Read More

Tax Bracket Creep

We thought this might be a good time to take a look at the current income tax system and how you might be able to mitigate its effect on your take home income.

Read More

Home Mortgage Rates

With the significant increase in Home Mortgage Rates over the last 10 months, what options are there to minimise their impact?

Read More

How Much Do You Need to Retire?

If you feel like the answer to this question is a constantly moving target, you’re right. Working out how much you need to retire can be a complicated task.

Read More

Sustainable Investing

So what is sustainable investing, how can it help your bottom line & does it makes sense for more people to be considering?

Read More

Estate Planning

You probably have at least a vague idea about how you would like your assets, or your ‘estate’, to be divided amongst your family, loved ones and other potential beneficiaries, but you won’t be there to oversee what happens.

Read More

5 Small Business Strategies

There is a temptation in business to review small business strategies at the beginning of the new financial year, but sometimes a better choice can be the new calendar year.

Read More

Financial Planning For A Great Year

With the current high inflation, high interest rate environment, it has never been more important to take a serious look at your financial position

Read More

Retirement Planning For Small Business Owners

Retirement planning for small business owners can be much more complex than for employed people, due to a selection of factors.

Read More

Applying for a Mortgage

Applying for a mortgage is both exciting and scary, but there are a few things you should know, that can move the needle away from scary, towards exciting

Read More

Downsizing Before Retirement

This is a tricky question to answer because it impacts your lifestyle and your family as well as your finances. So there are a number of things to consider when weighing this decision.

Read More

Home Loan Mortgage Rates

Buying a home is usually the single most significant financial decision a person makes. With no end in sight for the predicted home loan mortgage rates rises, reviewing your home loan strategy makes a great deal of sense.

Read More

Small Business Insurance

There’s no doubt about it, running a small business is tough. Not only do you need to manage the business, but you need to think about the inherent risks and how you might manage those should the worst happen.

Read More

Estate Planning For Business Owners

Whether it is a family run business, partnership, or a company structure, you need to determine how ownership and running of the business will work should you not be available.

Read More

Why Start A Business?

One of the key things to remember when you delve into the waters of setting up your own business, is that you are working towards future goals.

Read More

Cashflow Tips

So what can we do to manage our finances as effectively as possible in this current environment?

Read More

Family Business Succession Planning

One of the most important things you can do as a family business owner is succession planning. You haven’t spent years of your life building a successful business only to have it fall over when you want to retire, or are no longer able to run it.

Read More

Investing in Property

Owning your own home has long been known as the Great Australian Dream, but these days, investing in property seems to come a pretty close second.

Read More

Keeping Up With The Joneses

The Keeping Up With The Joneses Mindset Can Have A Devastating Effect On Your Finances & Result In Insufficient Funds To Support You In Retirement

Read More

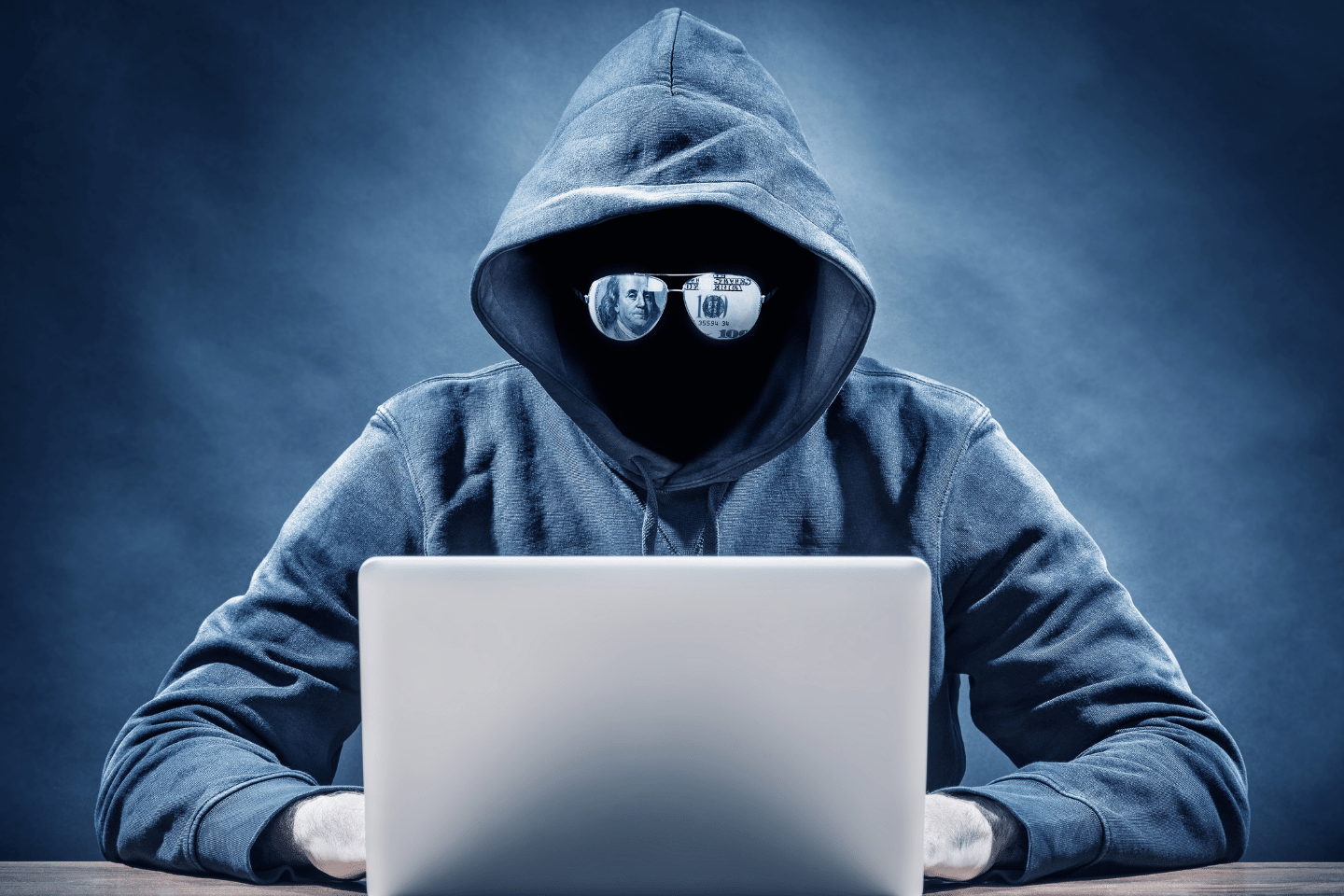

Get Rich Quick Schemes

High returns usually come with high risk, so when a scheme sounds too good to be true, it probably is!

Read More

Insurance Cover

Australia has certainly been through the wringer over the past three years. As confronting as it may be, it is essential to be prepared for the unexpected & understanding what insurance cover you need is a good start point

Read More

Quarterly Economic Update

As bad as this might seem, Australia still has one of the lowest inflation rates among OECD nations, beaten only by Japan and Switzerland, at the bottom of the inflation table

Read More

Saving for Retirement?

Saving for Retirement or Supporting Your Children? There are ways to do both & still ensure you have enough to retire comfortably, but it requires a little bit of planning

Read More

What is Inflation?

So what is inflation? It’s a complex beast & understanding the impact it can have will help you make wiser financial decisions.

Read More

Financial Fraud

Personal and financial fraud is on the rise. 11% of Australians experienced some form of fraud in 2021 & losses due to investment fraud were up 119.6% compared to the same period in 2020.

Read More

Saving For A House Deposit?

Should you invest your house deposit savings? This article investigates the pros & cons through a mini case study.

Read More

Inheritance & Movement Of Wealth

Australians pass on average $561,000 to their heirs, almost four times the global average of $148,000, with two in every three Australians planning to leave an inheritance.

Read More

Inflation & The Cash Rate

What is the Cash Rate & how will the changes applied today impact inflation and your financial situation?

Read More

2022-23 Federal Budget Highlights

The Federal Government has delivered a big-spending 2022 budget, taking immediate steps to reduce cost of living pressures for working Australians while implementing a range of massive infrastructure and defense spending measures.

Read More

Working from Home – Tax Optimisation Opportunities

Working from home and not sure what tax optomisation opportunities may be available to you, well this short article would be worth reading

Read More

Digital Assets – Pros & Cons For Investors

What are the advantages & disadvantages of digital assets compared with physical assets from an investors point of view?

Read More

BNPL vs Credit Cards – Which is Best?

BNPL (Buy Now Pay Later) or Credit Cards, what do they have to offer and which is the most financially efficient approach for consumers?

Read More

Portfolio Management During Turbulent Times

There’s no doubt we continue to live in turbulent times. Between the challenges and uncertainty of the pandemic, the instability in eastern Europe & ongoing supply chain issues, effective portfolio management is a prominent topic amongst investors.

Read More

Super Success For Women

While women earn less and spend less time in the workforce than men, sharply eroding their super contributions throughout their working lives, there are some simple steps women can take to boost their retirement savings.

Read More

Retirement Cashflow

Low-interest environments are great for borrowers but can be a disaster for retirees reliant on interest to provide retirement cashflow.

Read More

Stock Market Corrections

Stock Market Corrections can be an opportunity or a curse, depending on how you have set up your investments, are you taking full advantage of the opportunities?

Read More

Ethical Investing

Ethical Investing – what does this mean for you as an individual investor, what should you look for & why does it even matter?

Read More

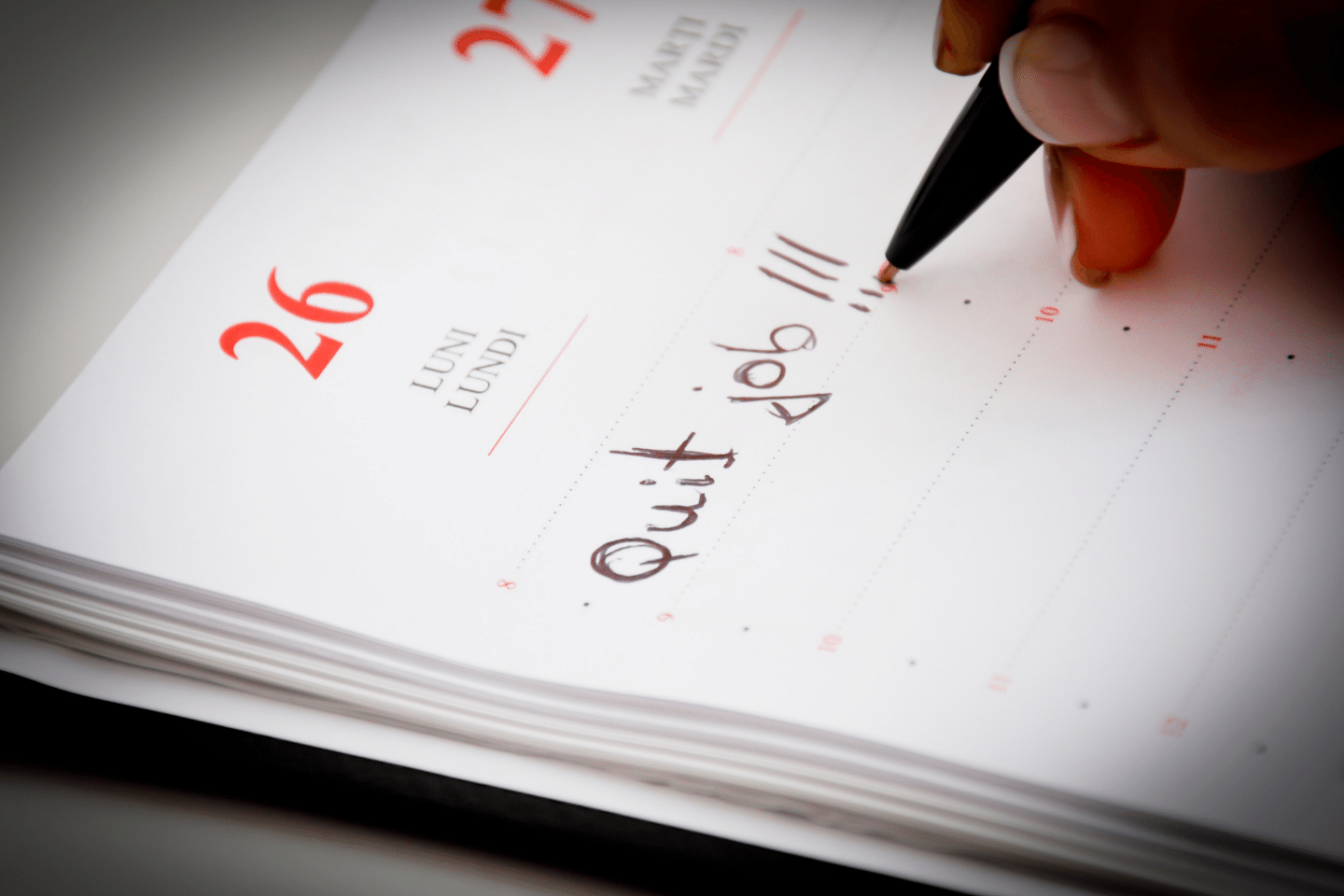

The Great Resignation

What is the Great Resignation, is this a trend you should be part of & how is it impacting business owners as well as investors?

Read More

Transitioning To Retirement?

Transitioning to retirement & not sure of the most tax-efficient method or whether a TRIS is needed?

Read More

Investing In Real Estate

If you are going to or are investing in Real Estate, there are a few key things to consider…

Read More

Financial Freedom

What is Financial Freedom, how is it different from Financial Independence and how do you achieve it?

Read More

Financial Literacy

One thing it’s important to understand, is being highly educated does not necessarily mean you have good financial literacy. The two do not always go hand in hand

Read More

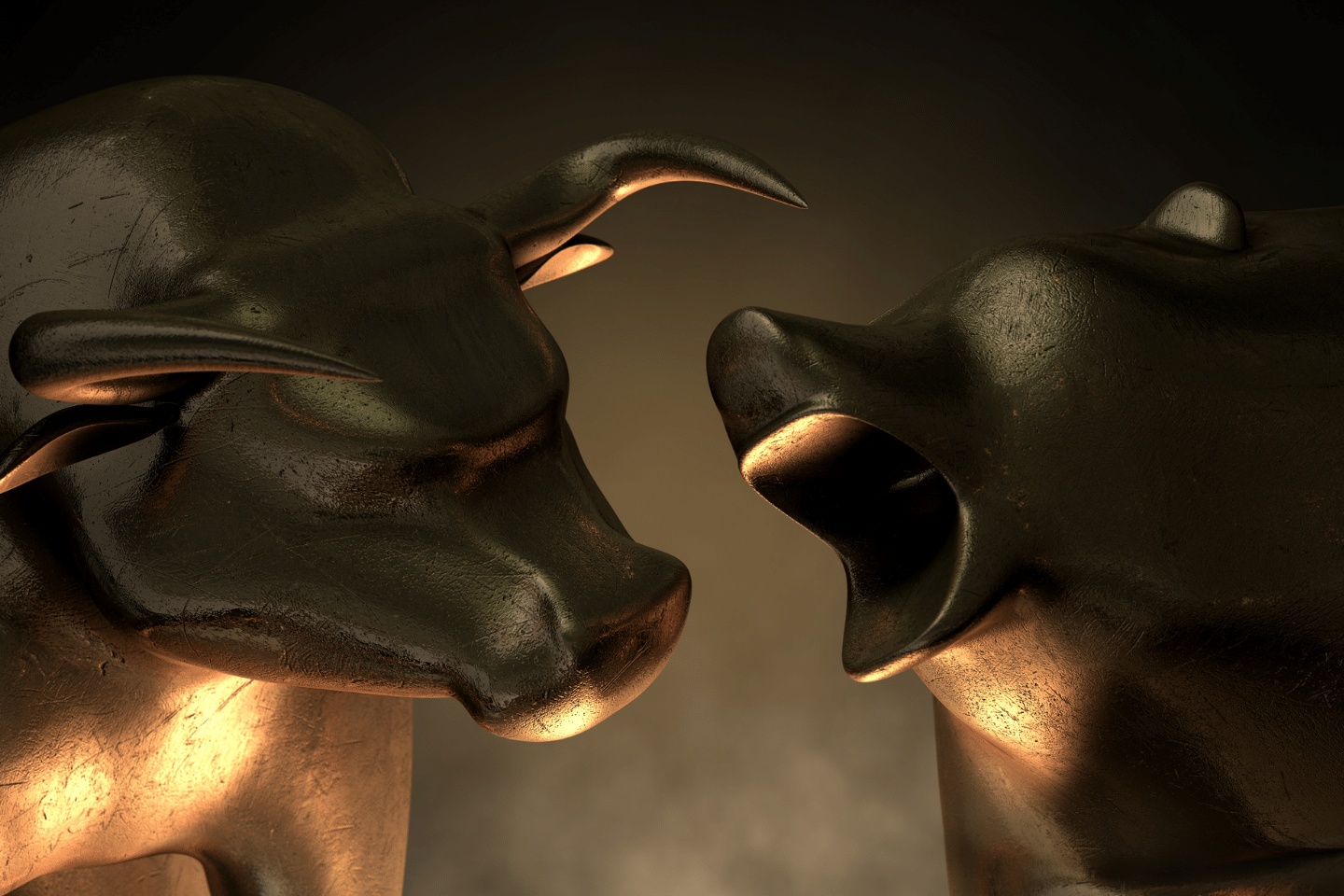

Bull vs Bear Market

Understanding the difference between a Bull & Bear Market, combined with the opportunities they present, can help greatly when formulating an investment strategy.

Read More

Stocks And Shares – What You Need To Know

So, when it comes to stocks and shares, what do you need to know before investing? Understanding the language can be a great first step.

Read More

What To Do With An Inheritance

Sometimes in life a small or not so small windfall comes our way. It can be tempting to rush out and spend it, but it is worthwhile taking the time to think about how best you can make this money work for you.

Read More

Financial Planning For Women

While preparing a financial plan is much the same for men and women, there are a few key things we need to factor in when developing financial plans for women.

Read More

Retirement Planning Strategies

It may seem obvious, but lack of planning is what can lead to disappointment come your retirement party.

Read More

Independent Financial Advice

How do you make sure the advice you are getting is independent and perhaps more importantly transparent?

Read More

Are Gifts Tax Deductible?

According to the Tax Office, not all gifts are created equal. Depending on the type of gift, and more specifically, to whom the gift is made, the tax implications of gift giving differ.

Read More

What Are Family Trusts?

These days setting up a Family Trust Fund is not just for the wealthy. Many small business owners are using the vehicle of a Family or Discretionary Trust to protect their family from potential loss, whilst at the same time taking advantage of tax benefits.

Read More

Portfolio Reviews & Effective Approaches

So, you have a financial plan in place. You’re set. Right? Well, for a while at least. While financial experts sometimes disagree on methods or theories, there is one thing they all agree on, this is not a set-and-forget activity.

Read More

June Tax Preparation Tips

Tax time is one of those chores of life that nobody enjoys. It can be a real pain. Not only do you have to scramble to find all the receipts and statements you have misplaced over the course of the year, but there is often a fear that you will end up with a great big, unexpected tax bill. Or even worse – get an audit notice.

Read More

Best Way To Begin Investing

Not sure what the best way to begin investing? For many people, the prospect of starting the investment journey is daunting. How much do I need? What should I invest in? How can I make sure I make the right decisions?

Read More

The Compound Interest Formula

It’s likely you have likely heard this term the compound interest formula, bandied around a lot in financial circles.

Read More

The Impact Of Compound Interest

Almost unbelievably, the last time there was a rate rise in Australia was November 2010, when the rate went from 4.5% to 4.75%. It’s been…

Read More

How to be Financially Independent

We all strive for financial independence in retirement. But what if you could achieve…

Read More

How To Build Wealth In Your 50s

In your 50s, many people start to worry, even panic, that they have left it too late to start building the wealth they will need for their…

Read More

How To Start Investing – The Wealth Tank Concept

Almost unbelievably, the last time there was a rate rise in Australia was November 2010, when the rate went from 4.5% to 4.75%. It’s been…

Read More