Ingredients Of A Good Personal Financial Plan – Part 3 Mortgages

Posted on:

Raffi Pailagian

MBA, BSc, DipFP

Financial Planner / Managing Partner

Ingredients Of A Good Personal Financial Plan – Mortgages

The way you structure your mortgage, or mortgages, can have an enormous effect on the success of your personal financial plan.

Not only will it impact your cash flow, but it can have far reaching consequences on your tax position, even your ability to respond to opportunities and changing market conditions.

With interest rates at a record low and expected to stay that way for at least three years[i], there couldn’t be a better time to make sure your mortgages are set up to help you succeed. So what are some of the important factors to consider, and traps to avoid?

Why Your Mortgage is so Important

In the last issue of our Ingredients of a Financial Plan – Property series we talked about the importance of property in your plan.

Only the lucky few are in a position to buy a property without taking out a mortgage and since your own home is most often the single largest portion of your overall financial position, this makes your mortgage the single biggest financial transaction most people are likely to make. Best get it right then!

If you read our article How To Lower Your Mortgage & Reduce Your Debt, you will already have a good handle on what features to look for in a mortgage for your family home.

But it is not just your family home on which you might take out a mortgage. Investment properties can also make up a large part of your financial plan, and investment mortgages are very different to owner occupied mortgages. One of the key differences is the way the repayments are structured.

Principle and Interest vs Interest Only

Whilst there are many ways to structure a loan, there are two fundamental choices before you get down to things like interest rates and offset accounts.

Loans are repaid either as Principle and Interest or Interest Only.

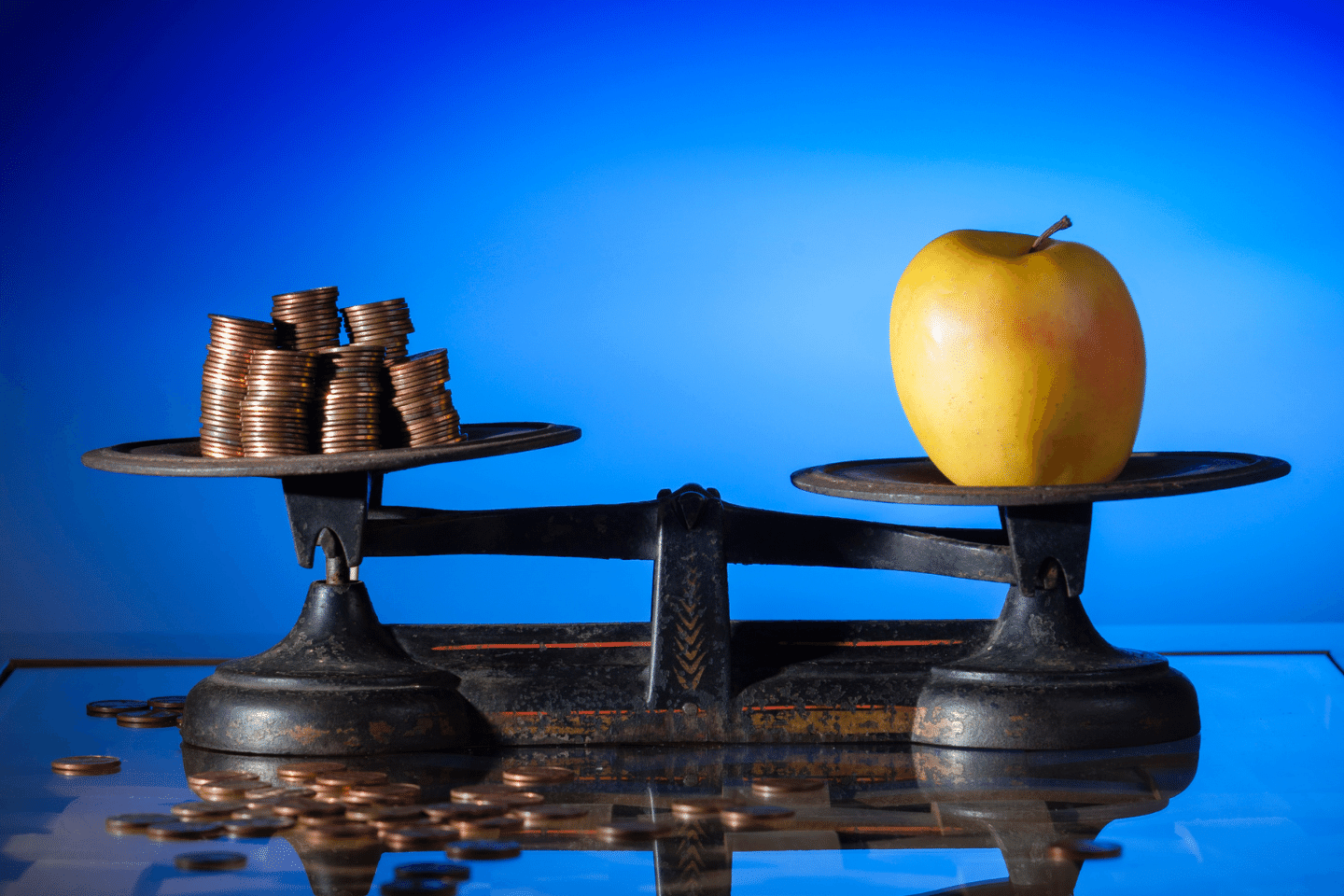

Owner Occupied homes are most commonly Principle and Interest, whilst many Investment Mortgages are Interest Only. There are pros and cons for both.

Principle and Interest

With this type of loan, as the name implies, you pay a portion of the principle, plus interest, in each instalment.

The primary benefit of this structure is that each payment reduces the amount of the loan, therefore the amount on which you are being charged interest.

It also means each payment is increasing your equity in the property, over and above the increase in its value. Most Owner Occupied Mortgages are set up as Principle and Interest.

Interest Only

Generally, Interest Only loans are used for investment properties. This is because a loan on an investment property can provide you with tax deductions that are not available to you on your Owner Occupied mortgage.

Due to this, in most circumstances, it is in your best interest to pay off your home mortgage first, but this is dependent on your financial situation.

It is also possible, though not all that common, to take an Interest Only option on an Owner Occupied loan for a short period of time. There are a few of instances where you might want to consider this option and I will outline one below.

At the outset of the loan an Interest Only option can help with affordability as the repayments are lower. This can also be useful when you have reduced income, such as one partner taking parental leave for a period of time.

However, this will increase the total interest you pay, can extend the term of the loan, and will reduce the speed at which you build equity in your home.

Investment Mortgages – Cross-Collateralisation vs Stand Alone Security

Often times when you are looking at taking out a mortgage for an investment property you will consider using the equity in your family home as collateral on the investment property.

How you go about structuring this can have long ranging effects on your finances and needs to be carefully considered.

Broadly speaking, unless you have a lump sum of cash available, you have two options; Cross Collateralisation or Stand Alone Security.

Cross Collateralisation

This is where the loan is secured against both the equity in your home and the investment property itself. This type of security is generally best used when your aim is to keep the property for upwards of 10 years, and you don’t intend to buy an additional investment property.

This is chiefly because cross collateralisation can be difficult to untangle if you wish to sell a property and the more properties you have, the more tangled the web becomes.

With this structure, a market downturn can cause a chain reaction, as each property is secured against the last. In this case, selling one property can mean you have to completely restructure your financing, which can be costly and time consuming.

However, this type of structure can mean you can sometimes negotiate a lower interest rate and it can provide you with some tax benefits.

Stand Alone Security

Stand Alone Security still uses the equity you have in your home, but only to provide you with a deposit for the investment property. The balance of the investment property is funded by a loan secured against that property alone.

The benefit of this strategy is that either property can be sold, and the relevant loan paid out with the proceeds of the sale, without affecting the other property. This provides you with much more flexibility in your decision making.

There may also be lower costs in relation to mortgage insurance or in moving your funding to a different lender should you decide your current lender is no longer appropriate.

Get the Right Advice

Once you have decided to invest in property, whether a home to live in or an investment, it is important to get trustworthy advice on the best structure for you.

There are pros and cons to any approach, and it is important to talk to someone with a good understanding of your overall financial position and future plans, as well as the options available to you. The right decision could make all the difference.

If you would like advice on the best mortgage for your needs, and how to structure it to maximise your financial potential, please contact us on 02 9976 3388 or click below and we’ll be in touch.

Interested in knowing more?Related

Related Posts

Investing In A Low Interest Rate Environment

Almost unbelievably, the last time there was a rate rise in Australia was November 2010, when the rate went from 4.5% to 4.75%. It’s been…

Read More

Intergenerational Wealth Transfer

In this episode we discuss intergenerational wealth transfer & optimal strategies you may want to consider

Read More

Tax Effective Investing In Australia

Is your investment strategy optimised for tax efficiency & what should tax effective investing in Australia ideally include?

Read More

Investment Opportunities

With so many investment opportunities being created by the current global market environment, where should you focus?

Read More

Building Generational Wealth

Understanding the principles behind building generational wealth is becoming of increasing interest, driven by amongst other things the current cost of living increases

Read More

Mortgage Rate Update

We are celebrating our 11th Year Helping clients reduce their interest rates and realise their dream of buying a home or investment property

Read More

De-Risking Business Growth

Although de-risking business growth stands as a fundamental goal for every ambitious venture, these 6 strategies are often overlooked

Read More

Super Death Benefit Tax

In Australia, superannuation is a nest egg many rely on for a comfortable retirement, but what happens to your super savings if you pass away?

Read More

The Concessional Contributions Cap

Understanding the concessional contributions cap can be a powerful tool for building retirement savings & maximising your super

Read More

Downsizer Contributions

What Is the downsizer contribution concession and why could this be relevant to you if you’re nearing retirement?

Read More

Risk Profiling

Risk Profiling is possibly the most important but often the most misunderstood and overlooked element when investing

Read More

How To Use Debt To Create Wealth

Not all debt is created equal. In fact, if you’re careful and think about it strategically, you can actually use debt to create wealth

Read More

Looking for a Home Mortgage?

Developing a good understanding of the key concepts, before looking at specific mortgage products, can help with fast tracking the selection process.

Read More

What Is Refinancing?

What is refinancing, when should you do it, does refinancing impact your credit rating, & is there anything else you need to know?

Read More

Financial Wellbeing

It’s easy to assume higher income means more financial wellbeing, and there is a strong correlation, but it is not the only factor at play.

Read More

Why Use A Mortgage Broker

With a wealth of information at all our fingertips thanks to the internet, you might wonder why use a mortgage broker?

Read More

Reasons To Refinance

With interest rates rising, it’s worth understanding how you can benefit by going to the trouble of refinancing.

Read More

Tax Deductions On Investment Property

Property is a popular investment asset, particularly in Australia, due to whole host of attractive benefits which include the allowable tax deductions on investment property

Read More

Tax Bracket Creep

We thought this might be a good time to take a look at the current income tax system and how you might be able to mitigate its effect on your take home income.

Read More

Home Mortgage Rates

With the significant increase in Home Mortgage Rates over the last 10 months, what options are there to minimise their impact?

Read More

How Much Do You Need to Retire?

If you feel like the answer to this question is a constantly moving target, you’re right. Working out how much you need to retire can be a complicated task.

Read More

Sustainable Investing

So what is sustainable investing, how can it help your bottom line & does it makes sense for more people to be considering?

Read More

Estate Planning

You probably have at least a vague idea about how you would like your assets, or your ‘estate’, to be divided amongst your family, loved ones and other potential beneficiaries, but you won’t be there to oversee what happens.

Read More

5 Small Business Strategies

There is a temptation in business to review small business strategies at the beginning of the new financial year, but sometimes a better choice can be the new calendar year.

Read More

Financial Planning For A Great Year

With the current high inflation, high interest rate environment, it has never been more important to take a serious look at your financial position

Read More

Retirement Planning For Small Business Owners

Retirement planning for small business owners can be much more complex than for employed people, due to a selection of factors.

Read More

Applying for a Mortgage

Applying for a mortgage is both exciting and scary, but there are a few things you should know, that can move the needle away from scary, towards exciting

Read More

Downsizing Before Retirement

This is a tricky question to answer because it impacts your lifestyle and your family as well as your finances. So there are a number of things to consider when weighing this decision.

Read More

Home Loan Mortgage Rates

Buying a home is usually the single most significant financial decision a person makes. With no end in sight for the predicted home loan mortgage rates rises, reviewing your home loan strategy makes a great deal of sense.

Read More

Small Business Insurance

There’s no doubt about it, running a small business is tough. Not only do you need to manage the business, but you need to think about the inherent risks and how you might manage those should the worst happen.

Read More

Estate Planning For Business Owners

Whether it is a family run business, partnership, or a company structure, you need to determine how ownership and running of the business will work should you not be available.

Read More

Why Start A Business?

One of the key things to remember when you delve into the waters of setting up your own business, is that you are working towards future goals.

Read More

Cashflow Tips

So what can we do to manage our finances as effectively as possible in this current environment?

Read More

Family Business Succession Planning

One of the most important things you can do as a family business owner is succession planning. You haven’t spent years of your life building a successful business only to have it fall over when you want to retire, or are no longer able to run it.

Read More

Investing in Property

Owning your own home has long been known as the Great Australian Dream, but these days, investing in property seems to come a pretty close second.

Read More

Keeping Up With The Joneses

The Keeping Up With The Joneses Mindset Can Have A Devastating Effect On Your Finances & Result In Insufficient Funds To Support You In Retirement

Read More

Get Rich Quick Schemes

High returns usually come with high risk, so when a scheme sounds too good to be true, it probably is!

Read More

Insurance Cover

Australia has certainly been through the wringer over the past three years. As confronting as it may be, it is essential to be prepared for the unexpected & understanding what insurance cover you need is a good start point

Read More

Quarterly Economic Update

As bad as this might seem, Australia still has one of the lowest inflation rates among OECD nations, beaten only by Japan and Switzerland, at the bottom of the inflation table

Read More

Saving for Retirement?

Saving for Retirement or Supporting Your Children? There are ways to do both & still ensure you have enough to retire comfortably, but it requires a little bit of planning

Read More

What is Inflation?

So what is inflation? It’s a complex beast & understanding the impact it can have will help you make wiser financial decisions.

Read More

Financial Fraud

Personal and financial fraud is on the rise. 11% of Australians experienced some form of fraud in 2021 & losses due to investment fraud were up 119.6% compared to the same period in 2020.

Read More

Saving For A House Deposit?

Should you invest your house deposit savings? This article investigates the pros & cons through a mini case study.

Read More

Inheritance & Movement Of Wealth

Australians pass on average $561,000 to their heirs, almost four times the global average of $148,000, with two in every three Australians planning to leave an inheritance.

Read More

Inflation & The Cash Rate

What is the Cash Rate & how will the changes applied today impact inflation and your financial situation?

Read More

2022-23 Federal Budget Highlights

The Federal Government has delivered a big-spending 2022 budget, taking immediate steps to reduce cost of living pressures for working Australians while implementing a range of massive infrastructure and defense spending measures.

Read More

Working from Home – Tax Optimisation Opportunities

Working from home and not sure what tax optomisation opportunities may be available to you, well this short article would be worth reading

Read More

Digital Assets – Pros & Cons For Investors

What are the advantages & disadvantages of digital assets compared with physical assets from an investors point of view?

Read More

BNPL vs Credit Cards – Which is Best?

BNPL (Buy Now Pay Later) or Credit Cards, what do they have to offer and which is the most financially efficient approach for consumers?

Read More

Portfolio Management During Turbulent Times

There’s no doubt we continue to live in turbulent times. Between the challenges and uncertainty of the pandemic, the instability in eastern Europe & ongoing supply chain issues, effective portfolio management is a prominent topic amongst investors.

Read More

Super Success For Women

While women earn less and spend less time in the workforce than men, sharply eroding their super contributions throughout their working lives, there are some simple steps women can take to boost their retirement savings.

Read More

Retirement Cashflow

Low-interest environments are great for borrowers but can be a disaster for retirees reliant on interest to provide retirement cashflow.

Read More

Stock Market Corrections

Stock Market Corrections can be an opportunity or a curse, depending on how you have set up your investments, are you taking full advantage of the opportunities?

Read More

Ethical Investing

Ethical Investing – what does this mean for you as an individual investor, what should you look for & why does it even matter?

Read More

The Great Resignation

What is the Great Resignation, is this a trend you should be part of & how is it impacting business owners as well as investors?

Read More

Transitioning To Retirement?

Transitioning to retirement & not sure of the most tax-efficient method or whether a TRIS is needed?

Read More

Investing In Real Estate

If you are going to or are investing in Real Estate, there are a few key things to consider…

Read More

Financial Freedom

What is Financial Freedom, how is it different from Financial Independence and how do you achieve it?

Read More

Financial Literacy

One thing it’s important to understand, is being highly educated does not necessarily mean you have good financial literacy. The two do not always go hand in hand

Read More

Bull vs Bear Market

Understanding the difference between a Bull & Bear Market, combined with the opportunities they present, can help greatly when formulating an investment strategy.

Read More

Stocks And Shares – What You Need To Know

So, when it comes to stocks and shares, what do you need to know before investing? Understanding the language can be a great first step.

Read More

What To Do With An Inheritance

Sometimes in life a small or not so small windfall comes our way. It can be tempting to rush out and spend it, but it is worthwhile taking the time to think about how best you can make this money work for you.

Read More

Financial Planning For Women

While preparing a financial plan is much the same for men and women, there are a few key things we need to factor in when developing financial plans for women.

Read More

Retirement Planning Strategies

It may seem obvious, but lack of planning is what can lead to disappointment come your retirement party.

Read More

Independent Financial Advice

How do you make sure the advice you are getting is independent and perhaps more importantly transparent?

Read More

Are Gifts Tax Deductible?

According to the Tax Office, not all gifts are created equal. Depending on the type of gift, and more specifically, to whom the gift is made, the tax implications of gift giving differ.

Read More

What Are Family Trusts?

These days setting up a Family Trust Fund is not just for the wealthy. Many small business owners are using the vehicle of a Family or Discretionary Trust to protect their family from potential loss, whilst at the same time taking advantage of tax benefits.

Read More

Portfolio Reviews & Effective Approaches

So, you have a financial plan in place. You’re set. Right? Well, for a while at least. While financial experts sometimes disagree on methods or theories, there is one thing they all agree on, this is not a set-and-forget activity.

Read More

June Tax Preparation Tips

Tax time is one of those chores of life that nobody enjoys. It can be a real pain. Not only do you have to scramble to find all the receipts and statements you have misplaced over the course of the year, but there is often a fear that you will end up with a great big, unexpected tax bill. Or even worse – get an audit notice.

Read More

Best Way To Begin Investing

Not sure what the best way to begin investing? For many people, the prospect of starting the investment journey is daunting. How much do I need? What should I invest in? How can I make sure I make the right decisions?

Read More

How To Build Your Investment Portfolio

How To Build Your Investment Portfolio – Assets, Risk & Return

Read More

The Compound Interest Formula

It’s likely you have likely heard this term the compound interest formula, bandied around a lot in financial circles.

Read More

The Impact Of Compound Interest

Almost unbelievably, the last time there was a rate rise in Australia was November 2010, when the rate went from 4.5% to 4.75%. It’s been…

Read More

How to be Financially Independent

We all strive for financial independence in retirement. But what if you could achieve…

Read More

How To Build Wealth In Your 50s

In your 50s, many people start to worry, even panic, that they have left it too late to start building the wealth they will need for their…

Read More

How To Start Investing – The Wealth Tank Concept

Almost unbelievably, the last time there was a rate rise in Australia was November 2010, when the rate went from 4.5% to 4.75%. It’s been…

Read More