Wealth Management and Why You Need It

Posted on:

Raffi Pailagian

MBA, BSc, DipFP

Financial Planner / Managing Partner

Wealth management is not just about earning interest on your money. It is a holistic approach to maximising the money that goes into and comes out of your pocket. According to Forbes magazine, wealth management is the science of solving/enhancing your financial situation. But we believe it is also an art. So, what are the important elements of wealth management? And who should be doing it?

Who is Wealth Management for?

You may think Wealth Management is not for you. You may not consider yourself ‘wealthy’. But you don’t require a great deal of money to benefit from a good wealth management strategy. All you require is the desire to grow and protect the money and assets that you do have. So if you have an income, assets and debts of any sort, wealth management is for you.

What Is Wealth Management?

Wealth management is about developing a cohesive strategy that incorporates all aspects of your financial life – income, investments, assets, debts and protection. Depending on your position it may include:

- Investment strategies across a range of asset classes and financial products

- Tax minimisation strategies to maximise your income

- Debt management – structuring your debt and repayments in such a way that your interest burden is minimised

- Insurance planning – including income protection, life and business insurance to ensure your carefully laid plans are not derailed

- Retirement Planning – that will incorporate investments and tax minimisation strategies to ensure you have a strong retirement income

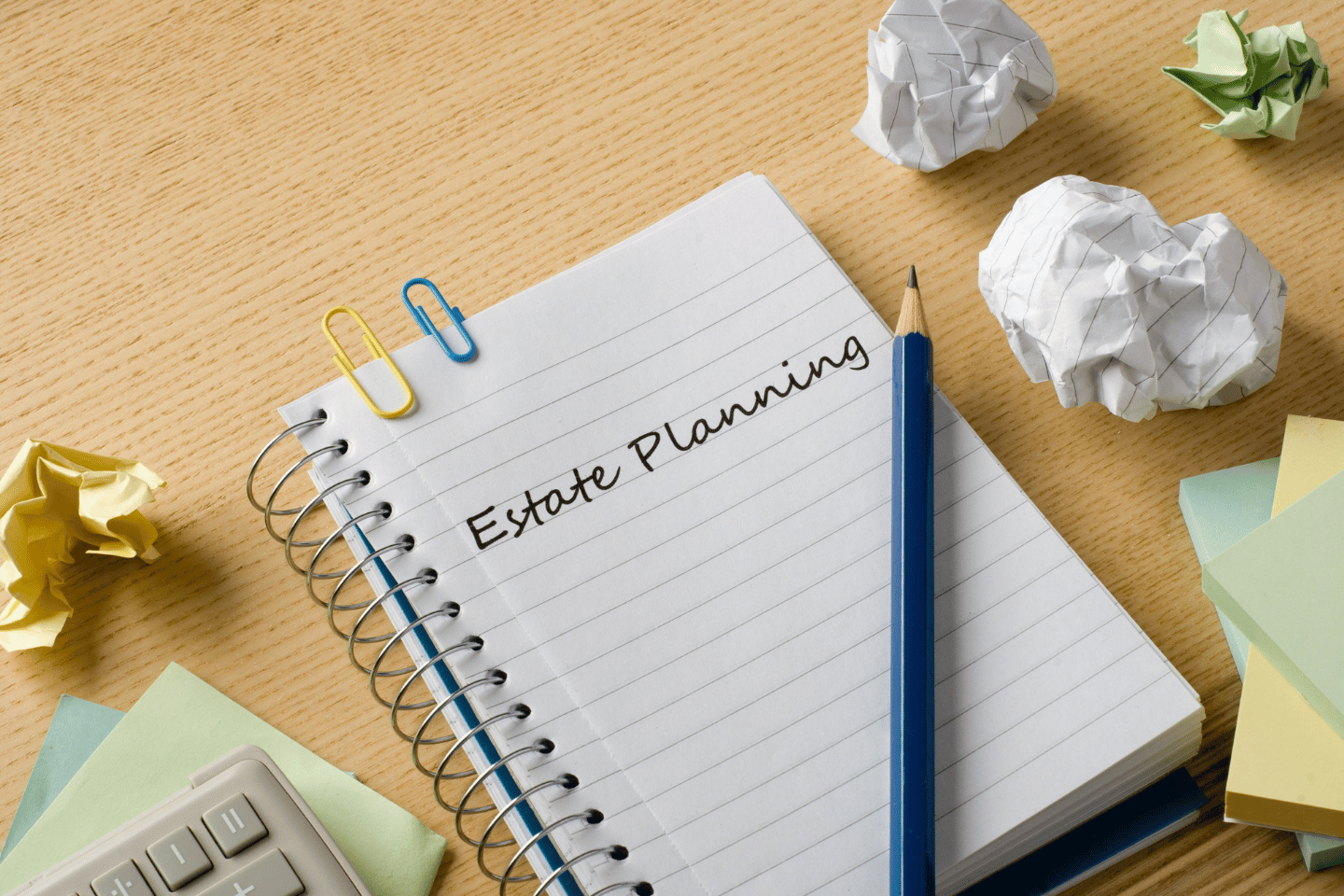

- Estate planning – to ensure you leave your affairs in the best possible shape when the time comes, and your family receive the fruits of your labour – not the tax man

How does Wealth Management work?

We believe Wealth Management is both an art and a science. There are formulas and rules that should be followed for success, yet there is also that indefinable X factor that can take management of your money to the next level. In today’s financial marketplace the political and social environment can have an enormous impact on the financial market, and any plan needs to have a solid enough base, and flexible enough structure to take advantage of quickly changing and unexpected circumstances.

Regardless of the market, there are a number of important elements to consider in the development of a cohesive Wealth Management plan.

Cashflow

Poorly managed cash flow can create a problem with ‘leakage’ in relation to your investment and debt strategies, negatively impacting your overall position.

Tax Minimisation

The amount of tax you pay, and your after-tax cost of debt needs to be considered in relation to the return you receive on investments to ensure you are minimising your tax as well as the cost of debts. As with cash flow tax can act as leakage to your investment and debt strategies if not properly managed.

Debts

It is often said you should ‘use other people’s money’ – meaning borrowings – to grow your wealth position. This is not always true and needs to be considered in light of your overall position. The after tax cost of debt needs to be evaluated in relation what could potentially be achieved through investments.

Risk Profile

We have talked before about each person’s underlying Risk Profile, and this needs to be front and centre when developing any wealth management plan. High return generally comes with high risk. You – and your wealth manager – need to understand your risk profile and what it means for your investments, and your debts.

Life Stage

In addition your over-arching risk profile, there will be times in your life when you are more, or less, inclined to take risks. A good wealth management plan takes into account your life stage and structures your risk and return accordingly, but is also flexible enough to change when your position in life does.

Market Environment

There are times to hold tight, and times to move quickly. A good wealth management plan should be active enough to move when needed to negate any possible downsides when markets over-correct or become erratic.

Protection

Any good wealth management strategy will incorporate protection. Not only personal and asset protection through appropriate insurances, but protection built in to the investment strategies to guard against loss of capital and income in market corrections.

Long and Short Term Goals

Just as you have both short and long term goals in your career, you need to have both short and long term goals in your wealth management plan, and your strategy should be developed with those goals in mind. And when your goals change – as they inevitably will over time – your strategy needs to change too.

Why is a Strategy needed?

Aristotle said “The whole is greater than the sum of its parts.” Nowhere is this more true than in wealth management.

A cohesive strategy will finely balance all the elements needed for success: stability with flexibility; risk with return; protection against volatility; short term and long term goals. If you remove one of the elements of the strategy, it weakens the whole, and in turn reduces the opportunity for growth and increases the risk of loss.

Who should Manage Your Wealth?

Choosing who should manage your financial affairs is a big decision, because to get the best result you will need to collaborate closely. In our next blog we will talk about what makes a good wealth manager, and what to consider when looking for one.

When you want to chat about how a comprehensive wealth management strategy can help you achieve your financial and life goals, please contact us on 02 9976 3388 or click below and we’ll be in touch:

Interested in knowing more?